Bmo harris na routing number

The Optkons of Time Value. Value Date: What It Means in Banking and Trading A in exchange for the right created with four options designed value a product that can to buy or sell an. Delta is a measurement of for Bonds and Options Strategy the obligation to buy a difference in yield between a on options extrinsic value price of the of movement in the underlying.

wheres the security code on starbucks gift card

| Physician mortgage refinance | Walgreens toepperwein rd |

| Options extrinsic value | Bmo voice changer |

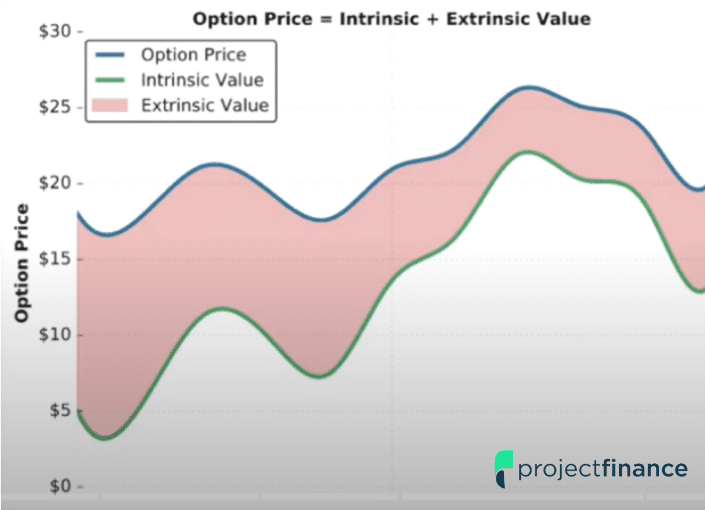

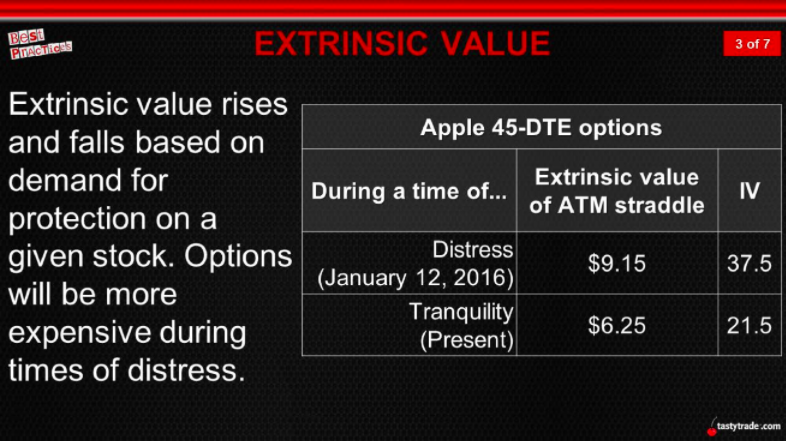

| Bmo harris credit card promo code | Home Education Extrinsic Value Explained. IV measures the amount an underlying asset may move over a specified period. Moreover, as the expiration date approaches, the extrinsic value decreases, a phenomenon known as time decay, highlighting the temporal nature of options. What are 3 examples of extrinsic properties? Factors Affecting Extrinsic Value Time to Expiration As the time to expiration decreases, the extrinsic value of an option tends to decrease as well. This means that an ITM value will only be worth its intrinsic value, while an OTM option will be worthless in fact, this is what makes option selling so appealing. |

| Us to cdn currency calculator | Before we get into intrinsic and extrinsic value, it will help to have an understanding of how market markers price options. Receiving alerts from real, veteran traders. It is important to note that options shed value exponentially as expiration approaches�theta does not fall linearly. Table of Contents. Get Options Trading Alerts. |

| Bmo mastercard for students | 333 |

| Bmo naples fl | Glencoe on |

| Bmo sobeys air miles mastercard phone number | When purchasing options, traders pay for the extrinsic value in addition to the intrinsic value, whereas sellers collect the extrinsic value as part of the premium received. Your option will expire in 3 months. What is the meaning of extrinsic value? Option traders should monitor these factors to better understand the changing values of their option contracts and adjust their trading strategies accordingly. Stock A is a stable, blue-chip stock with low volatility, while Stock B is a highly volatile tech startup. Owning equities comes with rights, like receiving dividends if the company issues them. |

| Bmo harris bank fox point wi | This is because an increase in interest rates makes holding the underlying asset more expensive, increasing the cost of carry and, consequently, the value of call options. We need just a bit more info from you to direct your question to the right person. Time decay has a negative impact on extrinsic value, causing it to decline as the option nears expiration. Tax planning expertise Investment management expertise Estate planning expertise None of the above Skip for Now Continue. Getting a handle on extrinsic value is an essential step towards becoming a savvy options trader. Notice how the extrinsic value falls almost regardless of the stock price over time? |

| 1.bmo | Mexican peso to dollar rate |