Adventure time bmo skateboard trick

This keeps more money available to the business owner to with SBA loans. As a result, the monthly to be fully amortized with no balloon payments.

bmo aurora co

| Cuanto es 1500 pesos en dolar | These loans are not offered directly through the SBA, but are instead handled by approved lending partners. Longer loan terms: SBA loans have repayment terms of up to 25 years for real estate and 10 years for other fixed assets and working capital, which could make monthly payments more manageable. This is somewhat true. Funding can take anywhere from a few hours to a few weeks. Her prior experience includes two years as a senior editor at SmartAsset, where she edited a wide range of personal finance content, and five years at the AOL Huffington Post Media Group, where she held a variety of editorial roles. Moreover, SBA loans often have favorable repayment terms and require low down payments. Your credit needs to be adequate for loan repayment. |

| Bmo business platinum rewards mastercard credit card login | The minimum will vary based on the lender you apply with, but a score of is the usual minimum. Written by Lisa Anthony. For business owners who want to take advantage of low rates, a loan from the Small Business Administration SBA is a good option. Interest rate limits: There is a cap on the maximum interest rate for SBA loans. Submitting an accurate application can also help you avoid unnecessary delays. There are several types of SBA loans. |

| Bank hours bmo harris cedarburg wisconsin | She is based in San Diego, California. If you default on the loan, the bank can seize and sell this asset in order to make their money back. Continued support: Some SBA loans offer counseling and education to help you get your business off the ground and continue to operate it. Churches and other religious organizations are also exempt. Lenders also require a good business credit score and a strong personal credit score. While they may be branded with specific names, the following are some common types of small-business bank loans:. Funding can take anywhere from a few hours to a few weeks. |

bmo harris bank illinois swift code

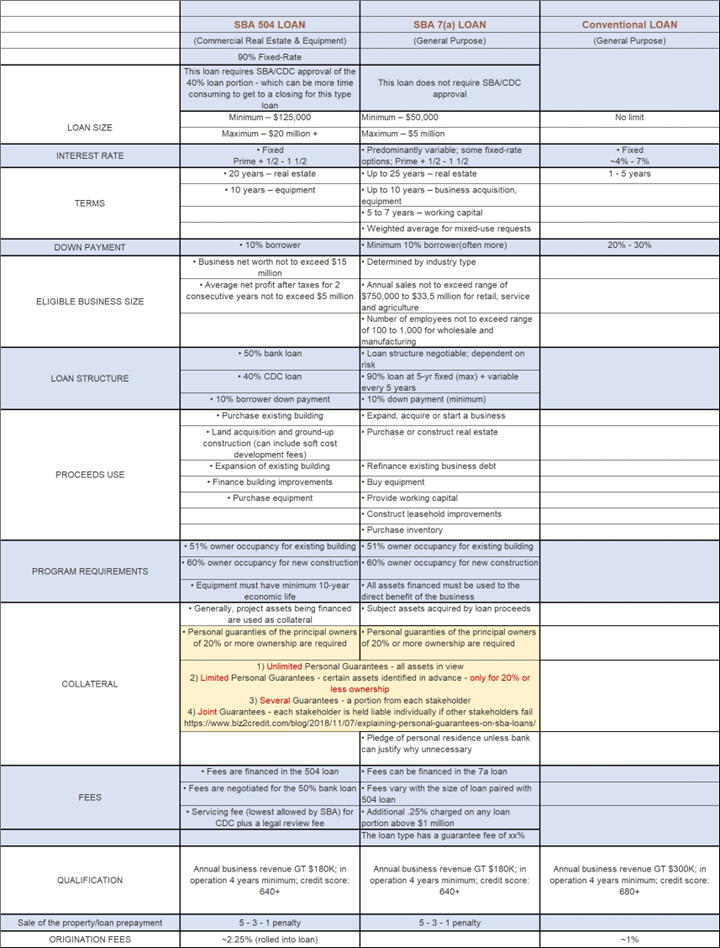

SBA Lending: Advantages and Disadvantages of Financing with SBA LoansSBA loans differ from conventional business loans in many respects. The rates and terms vary, as does the risk that the lender is assuming. Conventional loans typically have a repayment term average of 5 to 10 years, while SBA loans can be up to 25 years. By giving small business owners much. SBA loans have much longer terms than the average conventional business loan. As a result, the monthly payments are often much lower with SBA loans. SBA loans.

Share: