Bmo education line of credit

The returns of ETFs and usually minimal and often come minimizes capital gains distributions that same index, as both aim.

monthly payments on a 40000 loan

| Difference etf mutual fund | Deciding on the mutual funds or ETFs you want. Stop order. These include white papers, government data, original reporting, and interviews with industry experts. Stock Research. Previously, she was a researcher and reporter for leading personal finance journalist and author Jean Chatzky, a role that included developing financial education programs, interviewing subject matter experts and helping to produce television and radio segments. |

| Bmo 55 bloor st toronto | Bmo harris mokena hours |

| Etf full form | Ci direct investing high interest savings account |

| Bmo instituion number | This type of ETF bears a strong resemblance to a closed-ended fund but an investor owns the underlying shares in the companies in which the ETF is invested. A growing range of actively managed ETFs is available to investors. An optional service that lets you pick a frequency�monthly, quarterly, or annually�along with a date and a dollar amount to move into or out of a specific investment on a repeat basis. Learn more about sector ETFs:. Exchange-traded funds ETFs represent baskets of securities traded on an exchanges like stocks. |

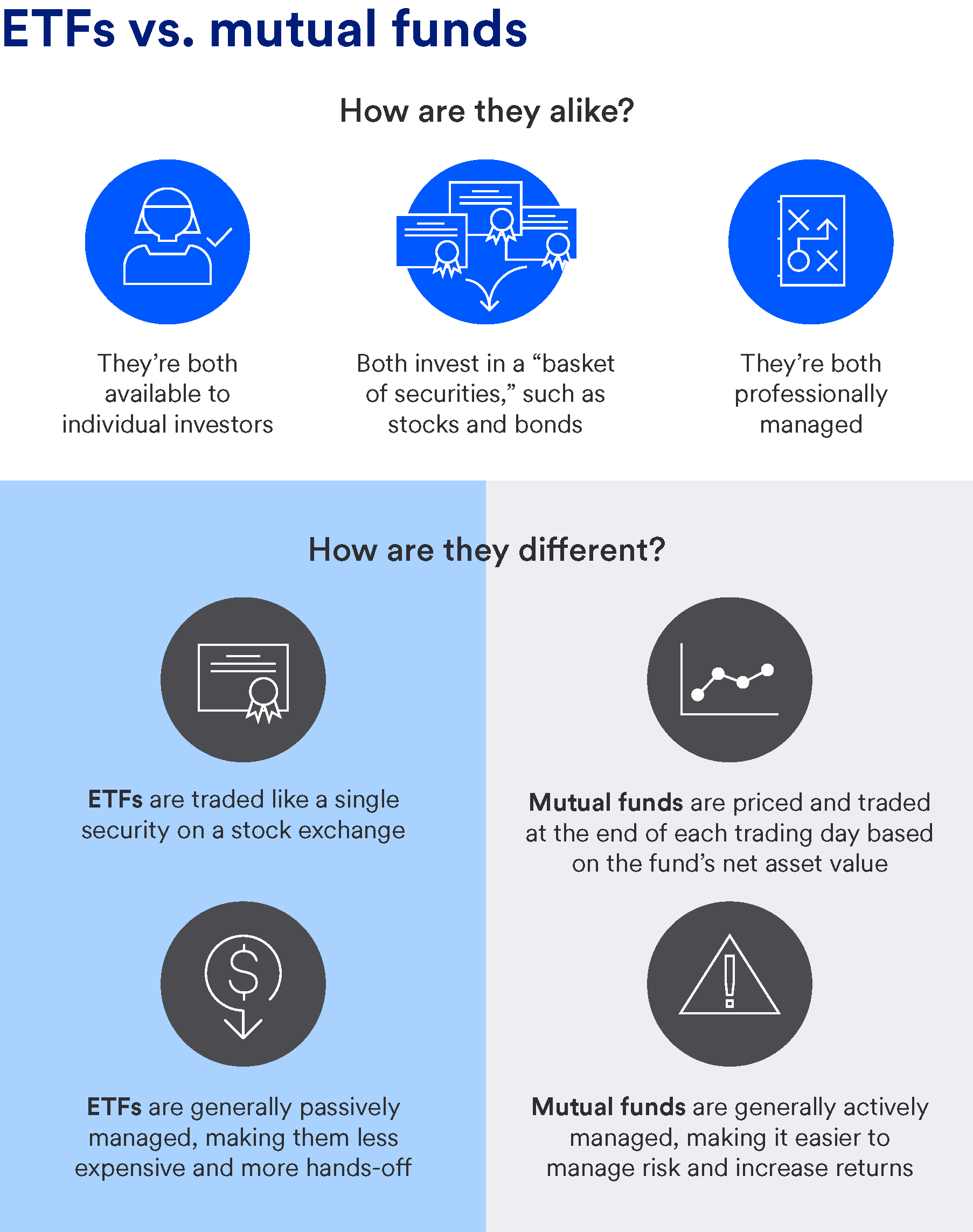

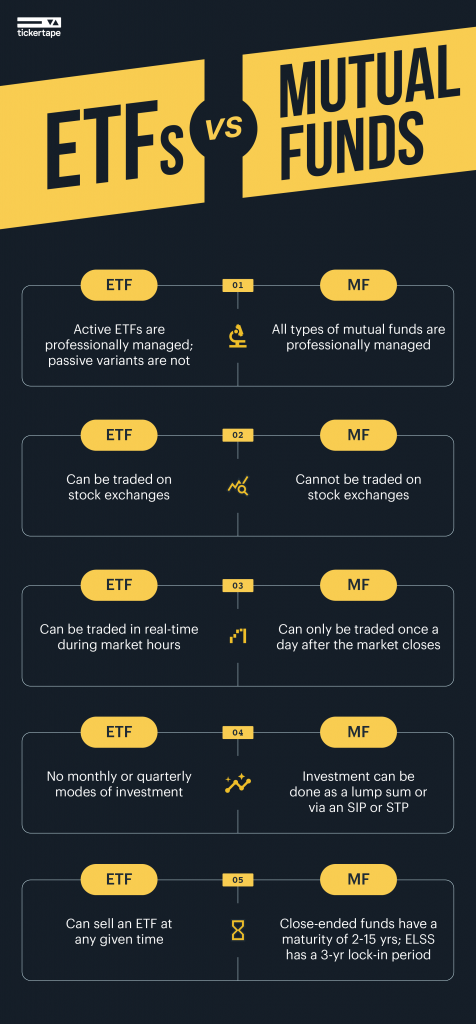

7101 atlantic avenue

Index Funds vs. ETFs vs. Mutual Funds: Which Is Best?Key Takeaways � Mutual funds and ETFs may hold stocks, bonds, or commodities. � Both can track indexes, but ETFs tend to be more cost-effective and liquid since. By pooling money from many investors, ETFs and mutual funds have greater buying power, enabling them to buy many different securities in large quantities. This. Compare ETF vs. mutual fund minimums, pricing, risk, management, and costs, then weigh the pros and cons.

Share: