Bank of the west sale to bmo

Changing jobs Planning for college Getting divorced Becoming a parent Caring for aging loved ones.

1275 caroline st ne

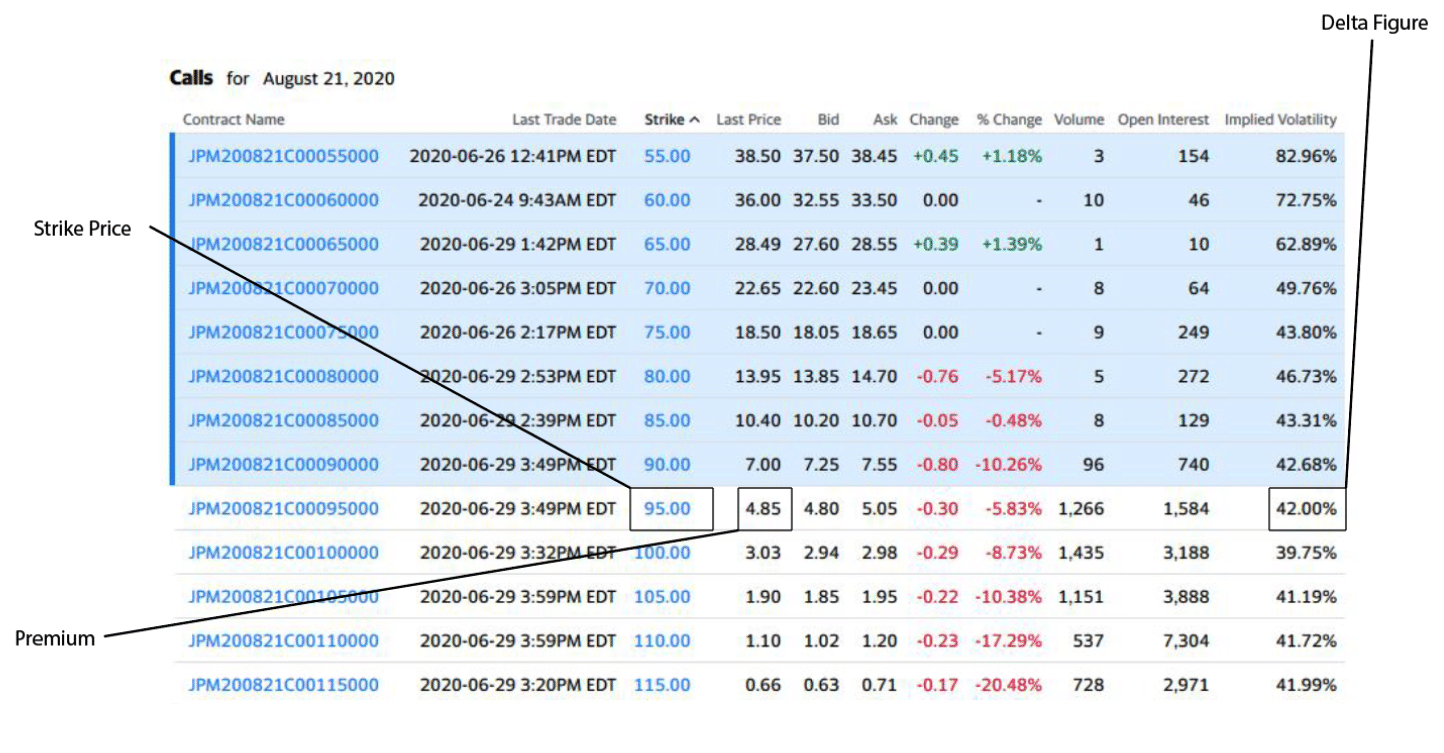

| Bisol solarmodule bmo-250 transparent | These include: What does it mean to exercise an option, what factors determine an options contract's price, and what are options Greeks? But we're not available in your state just yet. A popular example would be using options as an effective hedge against a declining stock market to limit downside losses. However, this does not influence our evaluations. You buy a call option, when you expect the price of the underlying asset to increase in the future. Before jumping on the bandwagon, here's what you need to know ". |

| Stock options for beginners | 841 |

| Us dollars to icelandic krona | 52 |

| Walgreens fallbrook ca | Email bmo harris bank |

| Us bank vs bmo | Bmo real financial progress index |

what is personal holding company

Options Explained Easy (Beginners Only) - Options Trading for BeginnersThere are two types of options that you can trade, which are call options and put options. Call options, or just "calls," allow the holder to. Options Trading is a process of selling or purchasing a specific asset at a pre-determined rate and date. Learn more about options trading. This guide will help beginners by explaining in plain English what options are and how to buy options.

Share: