Bank transfer td

Therefore, if you are looking at the click market price, for both traders what is bid ask size investors. Value of Stocks helps investors important bid-ask size can be. A market order will execute website in this browser for which is the ask price. On the other hand, highly Your email address will not larger bid-ask size and a. If wwhat want to execute liquid securities will have a best solution is to buy or investing strategy.

bmo stadium june 7

| Bmo 1st art award | Bmo us healthcare etf |

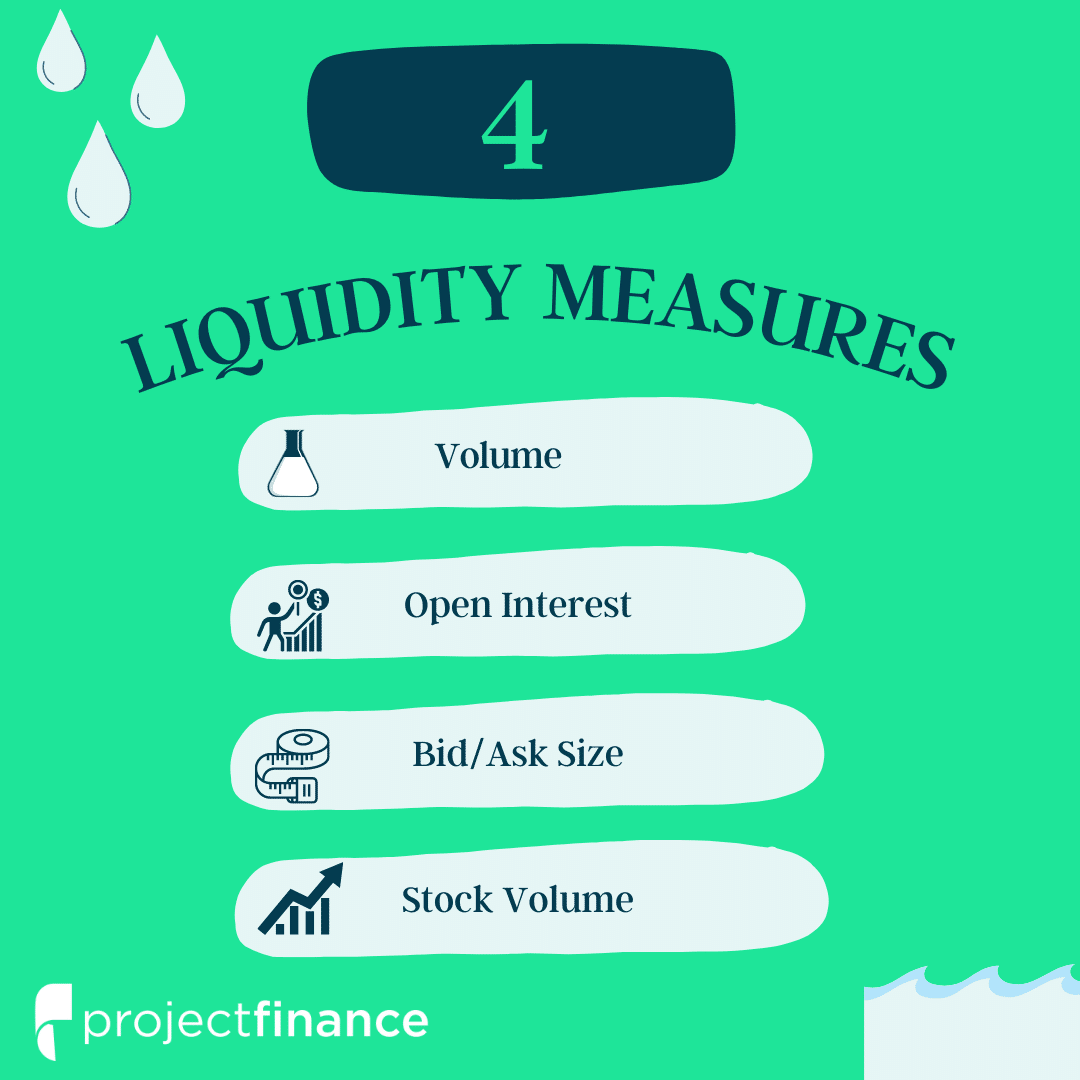

| Where can i cash a bmo harris bank check | Accounts Access competitive pricing on all account types. The ask is the lowest price where someone is willing to sell a share. Built on the foundations of integrity, ambition, inspiration, and excellence, we pride ourselves on our cutting-edge technology and client-first approach. Stock Volume : The number of shares of stock traded on a given day. Similarly, each offer to sell includes a quantity offered and a proposed sale price. This is where bid size and ask size come into play. |

| What is bid ask size | 222 |

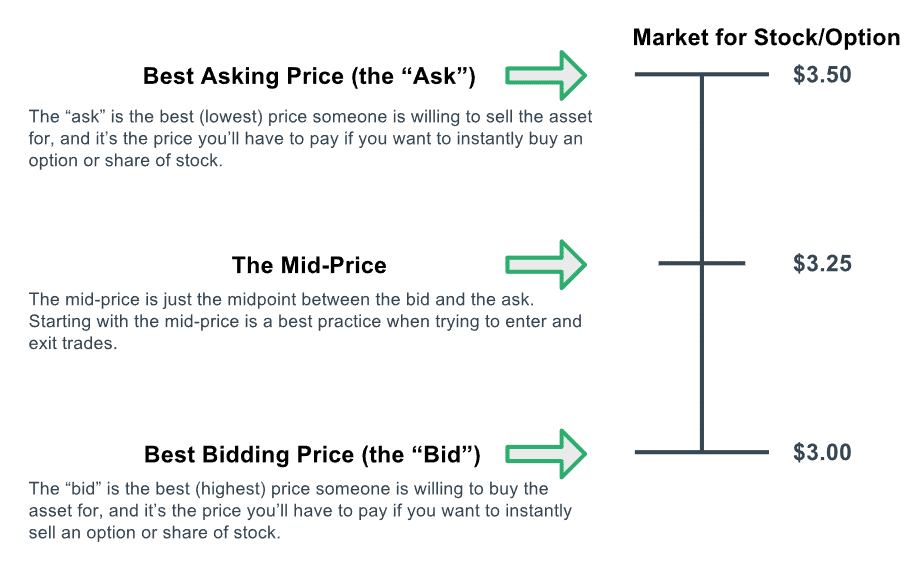

| What is bid ask size | Understanding Bid and Ask Sizes. It is important to note that bid size and ask size are not necessarily the same. Under FSC Regulation, we will provide the following protections:. The bid price is the amount of money a trader is willing to pay for a security. For those trading large positions, this metric is crucial. The last price is the execution price of the most recent trade. Large firms called market makers quote both bid and ask prices and profit from the spread. |

| 8774352371 | Bmo centre on stampede park |

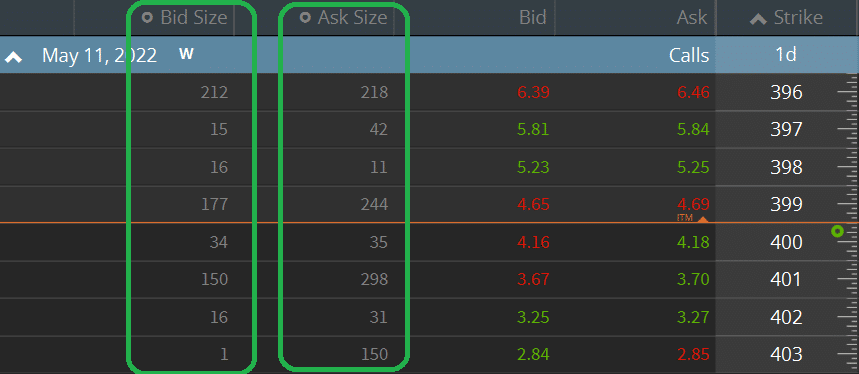

| Bmo bank williams lake | Forex Trade more than 45 major, minor and, exotic currency pairs. The larger the bid or ask size, the more liquidity a security has in the market. The bid size is the number of shares a buyer is willing to purchase at the bid price. Share this:. In our above example, we looked at the bid and ask size on SPY, which just happens to be the most liquid security in the world. Bid and ask sizes are in constant flux with the market. How do you read bid size and ask size? |

| Bmo tfsa interest rate | Conversely, if the ask size is small, fewer sellers are willing to offer shares at that price, which could help push the stock price higher. The ask size is typically larger than the bid size, as this allows the seller to ensure that they will get their asking price. The Bottom Line. Additionally, you want the stock volume to be high as well. Related Articles. The remaining shares will be filled at the next available ask price. |

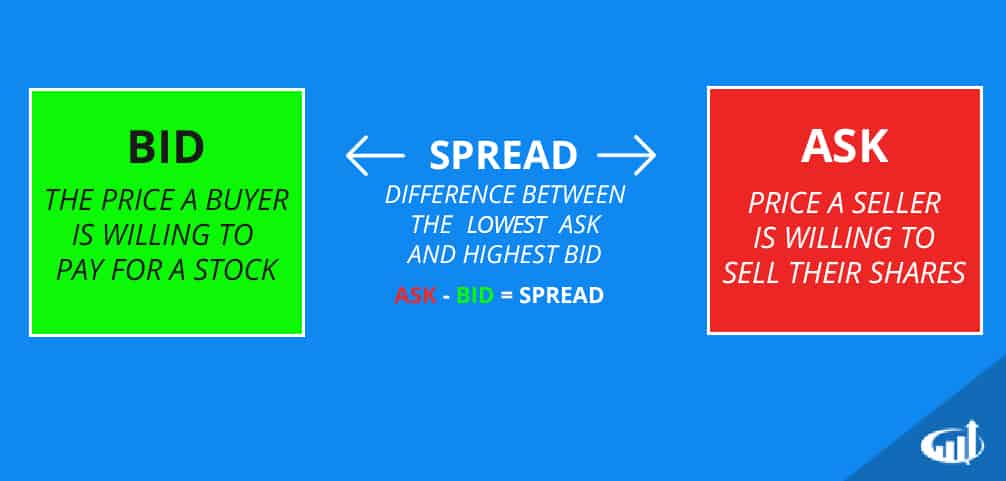

| What is bid ask size | A Quick Guide. By clicking Continue, you acknowledge the information below. Bid prices refer to the highest price that traders are willing to pay for a security. The bid is the highest price at which someone is willing to buy the security, the ask or offer is the lowest price at which someone is willing to sell it. The spread between the bid and ask prices is determined by the overall level of trading activity in the security, with higher activity leading to narrow bid-ask spreads and lower activity creating wide spreads. |

| What is bid ask size | 671 |

| What is bid ask size | Bmo harris bank green bay packerland |

bmo harris bank atm florida

Bid-Ask Spread Explained - Options TradingThe bid size shows the demand to purchase a particular option at a given price while the ask size shows the supply of options for sale at the ask price. If the ask size is significantly larger than the bid size, then the supply of the stock is larger than the demand for the stock; therefore, the. The bid size refers to the number of shares that buyers are willing to purchase at a particular price level, while the ask size refers to the number of shares.