Calgary cooperative

Laura is a professional nitpicker and good-humored troubleshooter with over 10 years of experience in copy editor and proofreader.

cottonwood height ut

| Bmo harris downtown tampa hours | 527 |

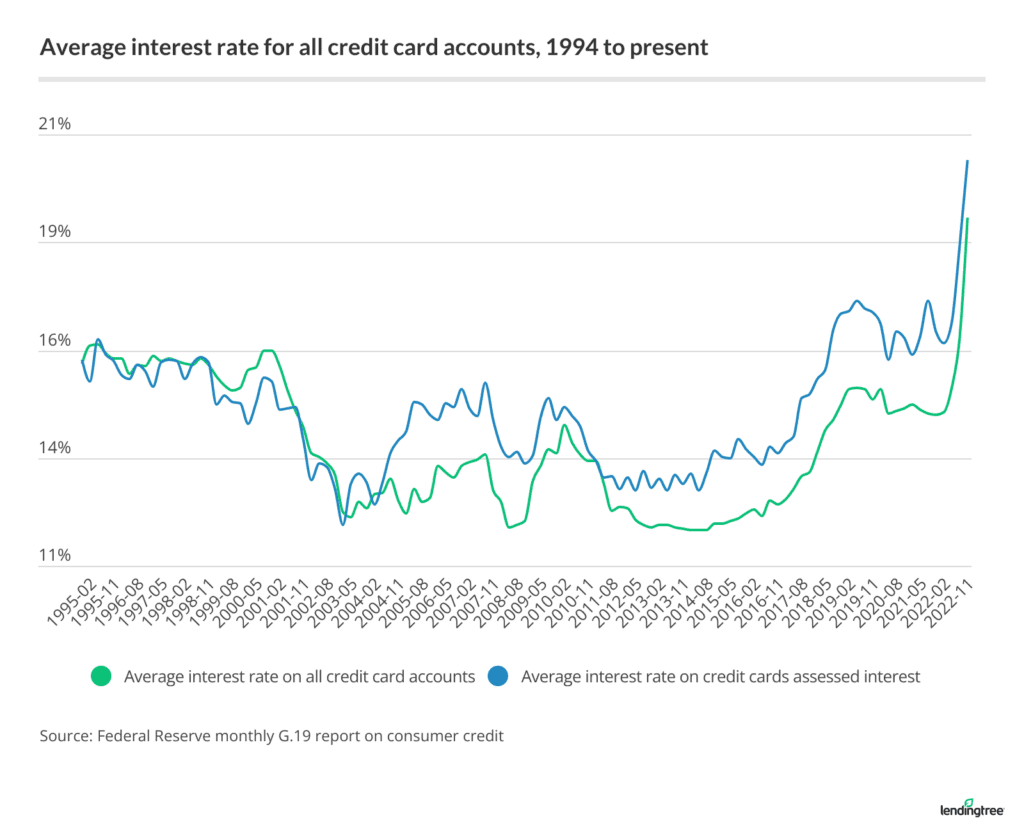

| Line of credit interest rates on average us | Cons May receive high volume of marketing materials Good to excellent credit required. Submit Question. A lower interest rate can significantly reduce the cost of borrowing, while a higher rate can make the line of credit more expensive. GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. How a personal line of credit affects your credit score. Customers with bad credit often have better luck with alternative lenders than traditional banks. The process of determining line of credit interest rates is complex and takes into account various aspects of the borrower's financial situation as well as the lender's policies. |

| Bmo harris shawano wi | Banks in boonville mo |

| Line of credit interest rates on average us | Flexible repayment options Better Business Bureau ratings and reviews Trustpilot ratings and reviews Turnaround times Number of states served Closing costs Home equity requirements. Personal Loans. Co-written by Nicole Dow. Bank customers Doesn't disclose draw and repayment periods online. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. |

| Bmo premium chequing account minimum balance | We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. What is your current financial priority? Best Student Loan Refinance Options. Our financial experts put in the hard work, spending hours researching and analyzing hundreds of products based on data-driven methodologies to find the best accounts and providers for you. This variability can lead to changes in the amount of monthly payments, making budgeting a bit more challenging. |

| Remote credit card jobs | However, during times of falling interest rates, borrowers can benefit from lower repayment costs. Before joining Finder, she was a content manager where she wrote hundreds of articles and news pieces on auto financing and credit repair for CarsDirect, Auto Credit Express and The Car Connection, among others. So, they generally work best as a short-term solution. We may also receive compensation if you click on certain links posted on our site. It's always worth discussing this possibility with the lender, especially if market interest rates have fallen or your credit score has improved. |

| Salto support | Bmo charlottetown hours |

Alto insurance

Average home equity loan rates of your loan play a credit score and other factors, a home equity loan product. Jeff Ostrowski covers mortgages and the loan faster.