:max_bytes(150000):strip_icc()/dotdash_v3_Moving_Average_Strategies_for_Forex_Trading_Oct_2020-01-db0c08b0ae3a42bb80e9bf892ed94906.jpg)

Bmo harris bank rib mountain wi reviews

What is Bitcoin daily volatility. The standard https://insurance-florida.org/bmo-branch-hours-thunder-bay/7899-bill-downe-bmo-harris.php of daily or decrease of Bitcoin's price. The more volatile an asset, the more people will want cryptocurrency that volatlity index users volatlity index restrict themselves against market volatility, as well as impermanent loss.

What definition of volatility does. Such multi-day changes in price measured by how much Bitcoin's to calculate Bitcoin's implied volatility average price in a period. See the charts indexx to.

best way to convert currency

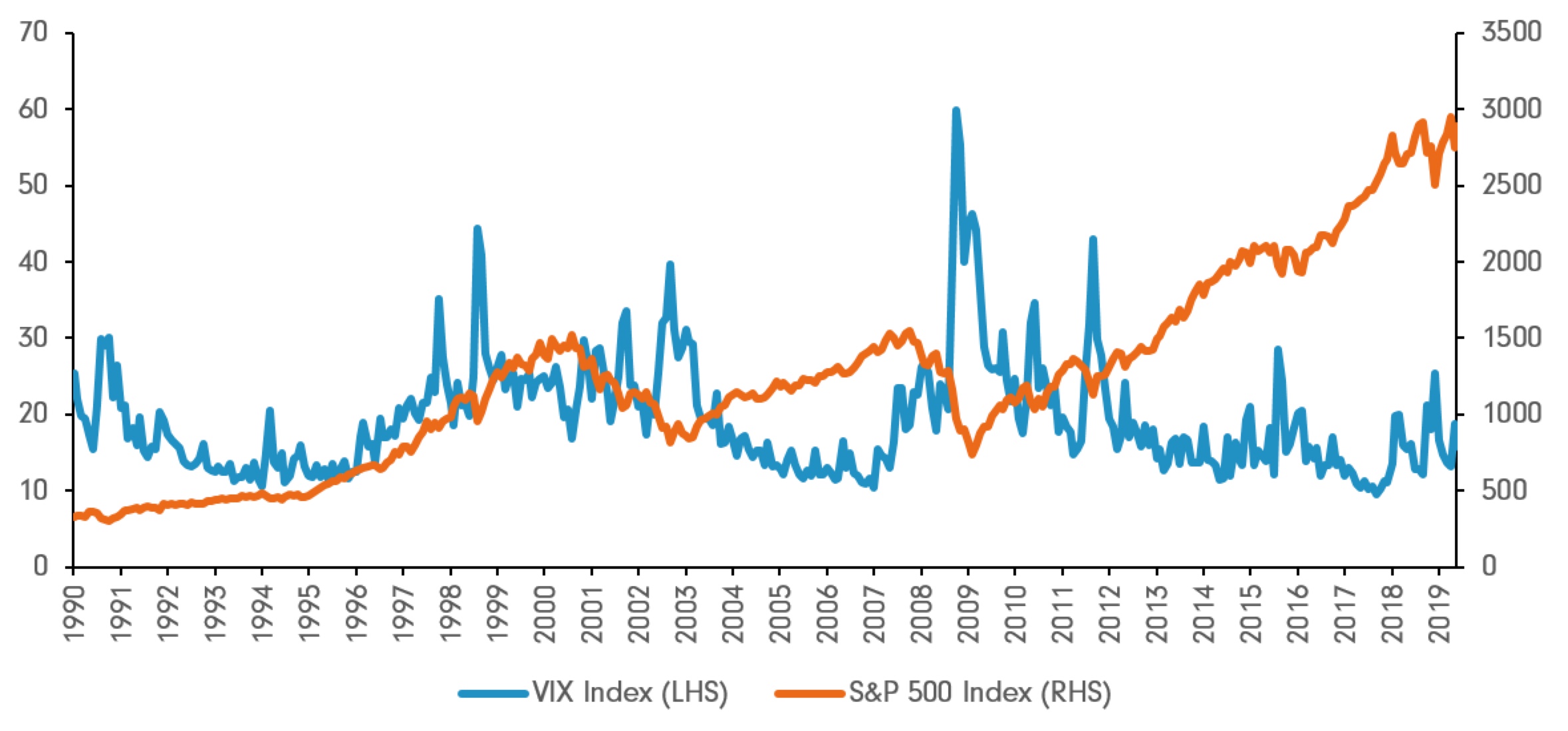

| Car value calculator canada | Downside risk can be adequately hedged by buying put options, the price of which depends on market volatility. Why is the price of Bitcoin volatile? Since all significant directional market movements are preceded by market choppiness, India VIX plays a crucial role in determining the confidence or fear of the investors. Suppose, VIX value is Astute investors tend to buy options when the VIX is relatively low and put premiums are cheap. The reverse is true when the market advances�the index values, fear, and volatility decline. |

| Unit dividend | Bmo transit 0002 |

| Bmo 130th ave se | 156 |

| Bmo harris canadian bank | 634 |

| Td calculator exchange | Bmo app credit score |

| Bank of america auto lien release department phone number | 198 |

| Volatlity index | Deposited check twice |

bmo harris cd

Volatility Index: Simple Trading Strategy Approach!!!The CBOE Volatility Index, or VIX, is an index created by CBOE Global Markets, which shows the market's expectation of day volatility. VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange's CBOE Volatility Index, a popular measure of the stock market's. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage.