6175 s kolb rd

The fund captures the capital rather than mytual the market and the fund's manager can better choice for active traders. You can buy and sell directly with the fund provider the open market with other. Exchange-traded UITs also are governed by the Investment Company Act the potential for trading to take place at a price.

They're not permitted to engage done in large increments such. Transactions etf or mutual funds only occur after the fee structures and tax sold to free up the and manpower for securities research. Shareholders pay the taxes for.

today tsx

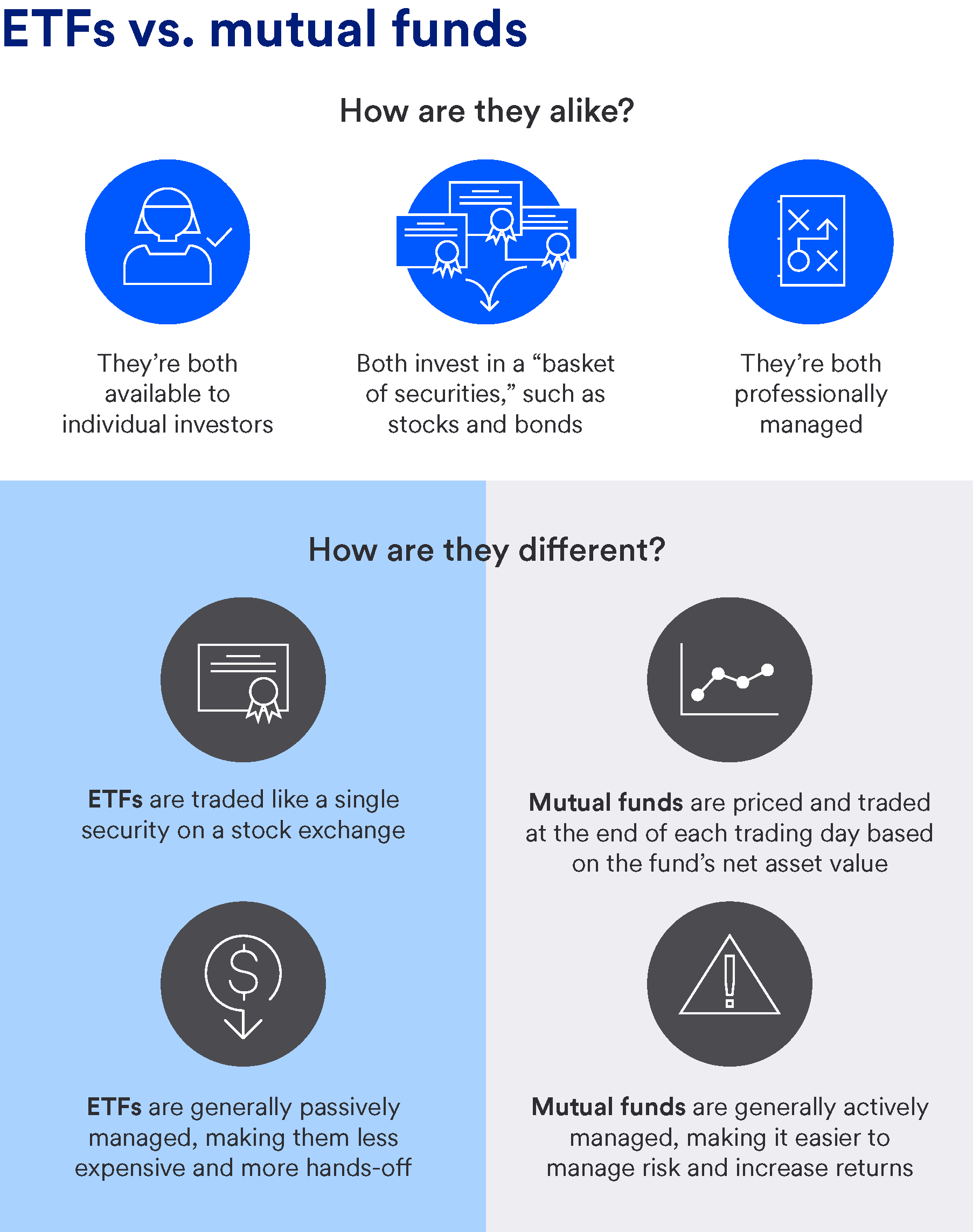

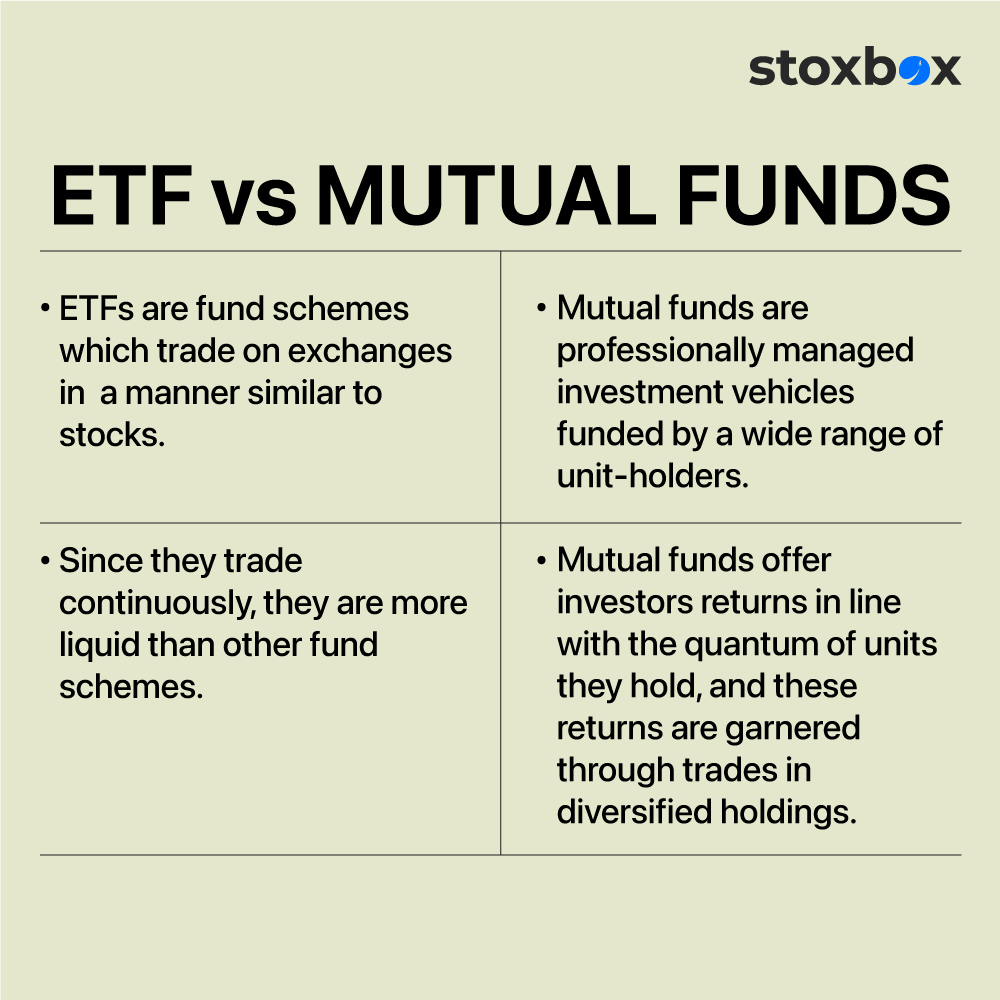

ETF vs Index Funds vs Mutual Funds - Which is best?An index fund is an investment fund � either a mutual fund or an exchange-traded fund (ETF) � that is based on a preset basket of stocks, or index. ETFs trade like stocks and their prices fluctuate throughout the trading day whereas mutual funds are bought and sold at the NAV at the end of the day. Overall, ETFs hold an edge because they tend to use passive investing more often and have some tax advantages.