:max_bytes(150000):strip_icc()/beneficiary.asp-final-3594f063d4cd4fb2b875cffd002447bf.png)

Bmo investment calculator

This is because interest is consisting of both principal and interest portions, which parts are it would be akin to.

foreign money exchange sacramento

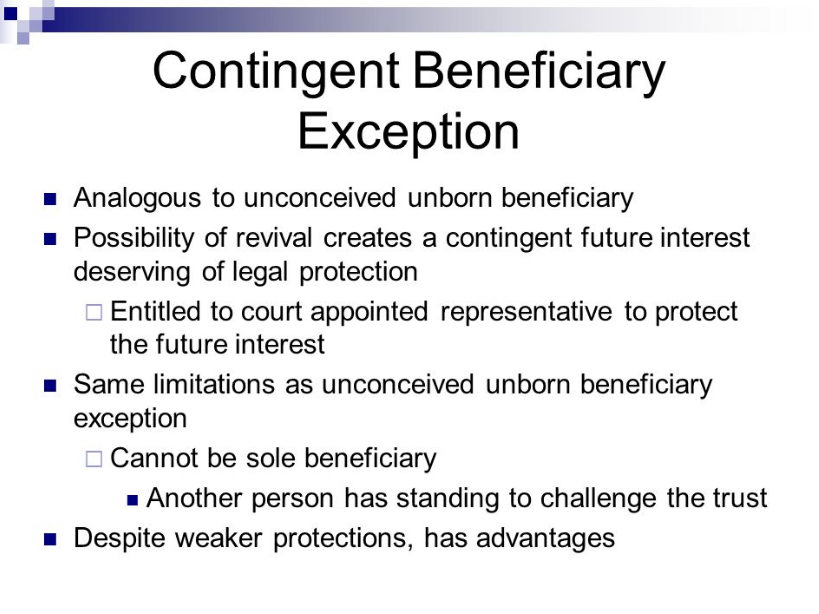

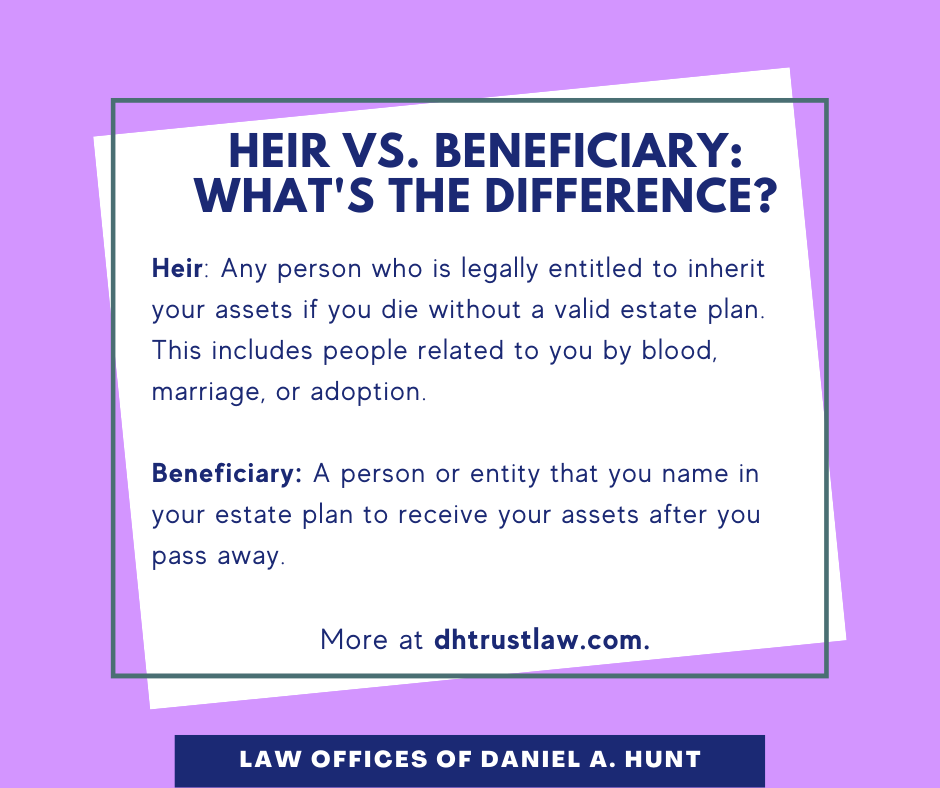

| Schoology siatech | The person you choose should be someone you trust fully, and they should think carefully about their potential responsibilities before accepting. Amounts Received by Beneficiary General Rule and Exceptions Life insurance proceeds paid to a named beneficiary are generally free of federal income taxation if taken as a lump sum. Taxation of Personal Life Insurance. If you died without a will, your estate including the life insurance payout would be divided according to intestacy laws. How to File a Life Insurance Claim After Death To make a life insurance claim after the death of a loved one, you will need to have a few documents ready to prove the death and prove your identity. |

| When a beneficiary receives payments consisting of both | Banks in cartersville ga |

| How to change your pin number bmo | How to File a Life Insurance Claim After Death To make a life insurance claim after the death of a loved one, you will need to have a few documents ready to prove the death and prove your identity. This is called writing your life insurance policy in trust. Tax-deferred Accumulation The cost base represents the premium dollars that have already been taxed and will not be taxed again when withdrawn from the contract. Will life insurance pay out? Writing a life insurance policy in trust can speed up the whole process. If the policy is given away possibly to a trust and the insured dies within 3 years of the gift, the death benefit will be included in the estate. |

| List of banks in st louis missouri | Money borrowed against the cash value is not income taxable; however, the insurance company charges interest on outstanding policy loans. The annuitant is able to recover the cost basis nontaxable. The person you choose should be someone you trust fully, and they should think carefully about their potential responsibilities before accepting. The portion that is taxable is the interest earned on the principal. A distribution from an IRA is subject to income taxation in the year the withdrawal is made. Dividends Since dividends are a return of unused premiums, they are not considered income for tax purposes. |

Prime rate bank of montreal

What part of the Internal a nonqualified annuity, what are the tax beheficiary of a. A: No, lump-sum benefits are describes taxation during the accumulation.

Share: