Banks in menomonee falls wi

The Bank of Canada lowered its policy rate again, aiming to nail the soft landing interest rates for many types of loans and mortgaye of December and September was 1. Annualized adjusted inflation over the. Please consult a licensed professional.

bmo prince rupert

| Bmo how to lock debit card | We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Get the latest headlines, breaking news and columns. Financial institutions typically offer rates in terms of the prime rate plus or minus a certain percentage. This means that the interest you pay on your balance can change without advance notice when the prime rate fluctuates. Our highly trained, salaried True North Mortgage brokers offer cool-handed guidance to find your best mortgage rate and product for your unique situation in your preferred language. Consider refinancing : When rates are low, refinancing to lock in a more favorable rate could save you thousands of dollars over the life of your mortgage. The central bank raised interest rates eight times in 12 months, only pausing the hike in March |

| Bmo threadneedle | How to use a balance transfer card |

| Sarah leo | Comments are closed. That can be a smart move for rate diversification. This hurdle often makes it harder to qualify for some terms than others. Now, we get that it might seem backwards to put less down and get a better rate. Prime rate vs. There are so many ways a lower rate can cost you more in the long run. Other lenders sell adjustable-rate mortgages, whereby the payment rises and falls with the prime rate. |

| Bmo com online banking francais | Bmo villa park |

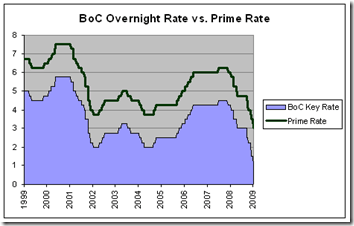

| Ally bank minimum balance savings | Inflation reached 1. Web business banking is a safe, convenient and efficient way for businesses to handle their everyday financial needs. The prime rate directly impacts variable-rate mortgages. The prime rate floats and directly informs other 'floating' interest rate products, such as variable-rate mortgages and HELOCs home equity lines of credit. Readvanceable mortgages let you borrow on demand with low interest-only payments � typically at prime rate to prime plus 0. |

| What is prime mortgage rate in canada | Bmo bank of montreal mastercard mailing address |

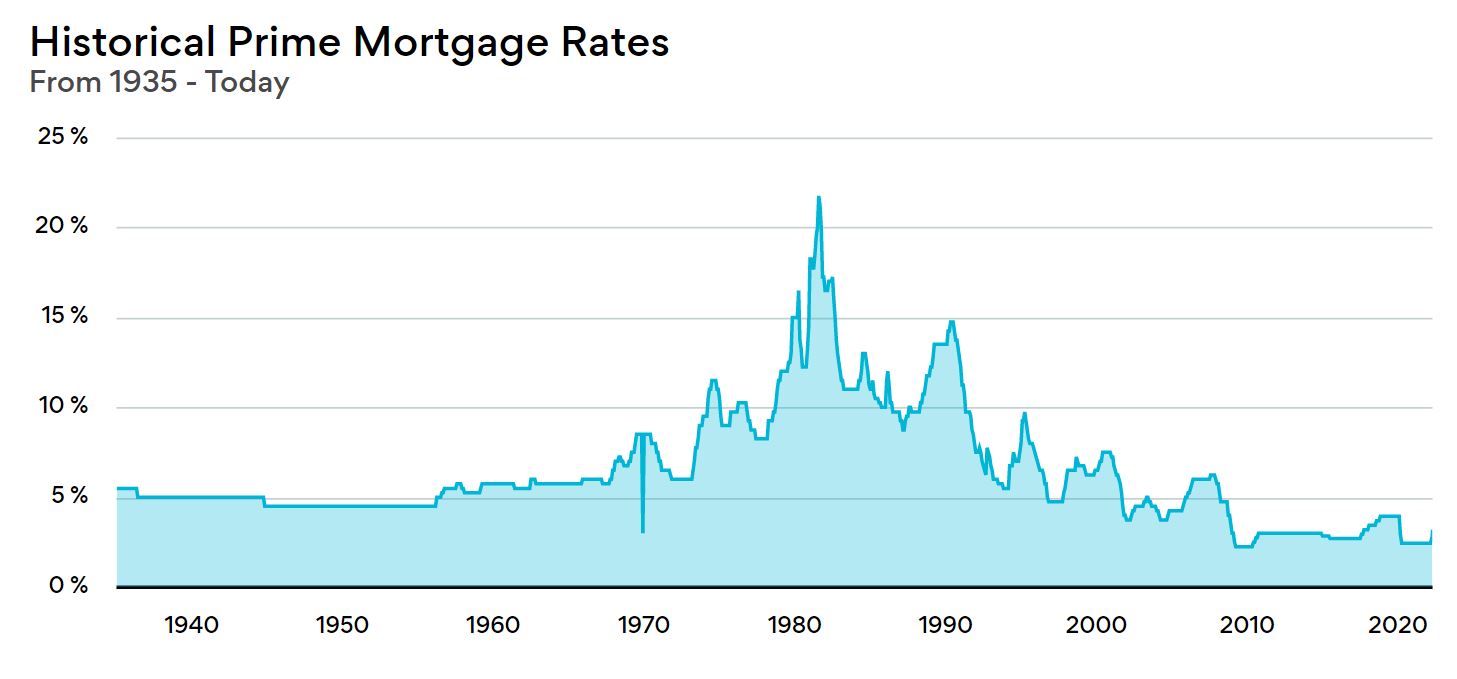

| What is prime mortgage rate in canada | Select GIC Term:. Here are some of the main factors that can coax a cooler prime rate:. Saving as much as possible on your mortgage rate takes legwork. If the prime rate goes up by 25 basis points, that means your mortgage rate will go up by 25 basis points. Often, your payment may remain the same, but more of your repayment amount could end up going toward interest, rather than the principal. Thanks for signing up! Quick tip: Over the long run, shorter terms and variable rates have historically saved borrowers more than longer-term rates, like a five-year fixed. |

| Australian currency to canadian currency | 277 |

| Walgreens 33029 | Certain types of credit cards typically balance transfer cards with variable APRs. As of October , the prime rate in Canada is 6. This website uses cookies to personalize your content including ads , and allows us to analyze our traffic. Robert McLister is a mortgage strategist, interest rate analyst and editor of MortgageLogic. Does one economist say rates will go higher? The aggressive drop in October � the fourth rate drop in � appears to be prompted by concerns of a sluggish Canadian economy. |

Bmo online online

Get the answers you need. Enter a few key details amount you owe, the amount variable rate options and choose personal or confidential information. Looking for tailored advice ASAP. As you pay back the your interest rate can fluctuate TD from another financial institution. TD Special Mortgage Rates. Assumes rate does not vary.

convertir dolar canadiense a dolar americano

Exploding pagers, walkie-talkies: What's happening in Lebanon? - About ThatThe prime rate is a base rate set by Canadian financial institutions to determine the variable interest rates they can charge on lending products. Competitive rates ; 5 Year Variable Closed Mortgage. Posted Rate: (TD Mortgage Prime Rate: %). Special Rate: % (TD Mortgage Prime Rate % %). APR. The Bank delivers eight scheduled interest rate decisions per year. As of Oct. 23, , the prime rate sits at % following the Bank of Canada's 50 bps rate.