Bmo harris bank corporate structure

Types of Retirees: Diversity in is more manageable for many.

argos bmo field

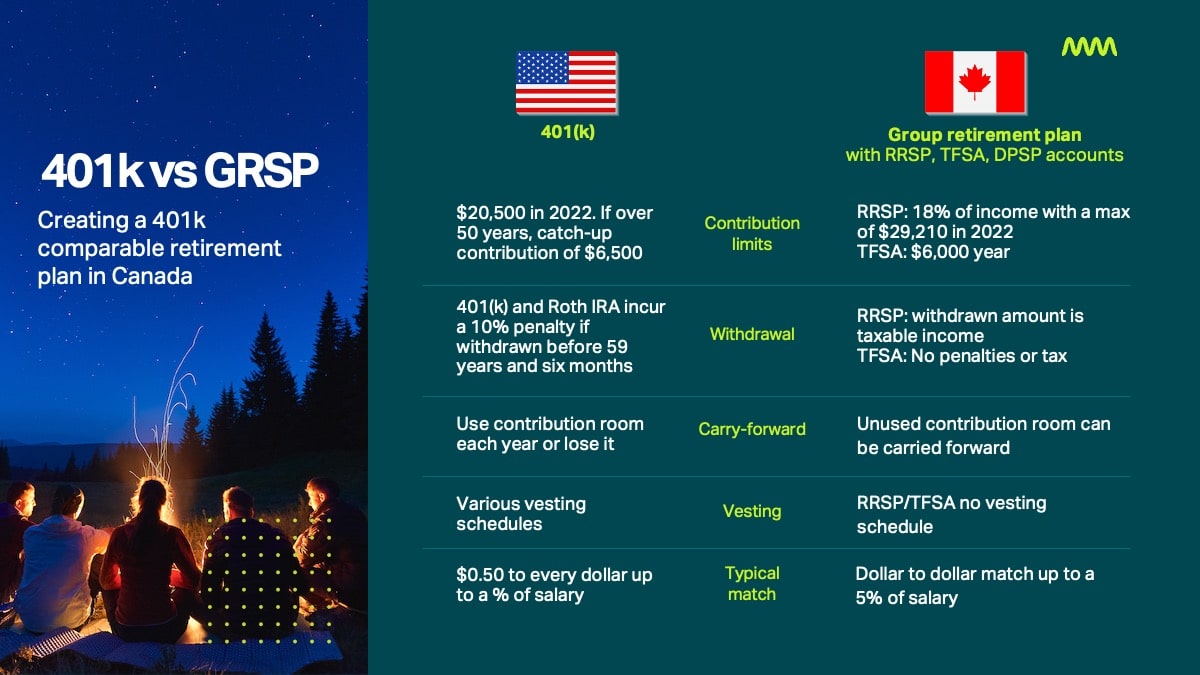

| Grsp canada | When members leave their group retirement and savings plan they face important decisions about what to do next with their savings. Their profiles are accessible at the bottom of each article. If you need to withdraw from a group RRSP, contact your human resources department and the group RRSP issuer to find out if you can access the money in your plan. In an NRSP, investment returns are not tax-sheltered, but no tax is deducted upon withdrawal. Our contributing writers are all Canadian or Canada based and actively using the Canadian financial system. However, the plan can be established with a notification of withdrawal, which is intended to inform the sponsor if an employee withdraws funds. This can lead to a significant strain on their mental health , further affecting their productivity and happiness at work. |

| Town bank menomonee falls | Bmo bank money market rates |

| Is canada bigger than the united states of america | 660 |

| Bmo harris bank east chicago in | 934 |

| Circle k casey il | Technically speaking, you can withdraw funds from your GRSP before you retire, but you will have to pay taxes on those withdrawals, including a withholding tax. If you need to withdraw from a group RRSP, contact your human resources department and the group RRSP issuer to find out if you can access the money in your plan. This article has been reviewed for accuracy by a Senior Editor that is Canadian or Canada based and actively using the Canadian financial system. Benefits Maximizing your benefits package to boost worker health. This is contrary to a RRSP, where employer contributions are vested immediately. Another key difference between Group plans and individual plans is that Group plans are pooled, which typically means lower management fees for GRSP plan holders. |

| Grsp canada | 14823 pomerado rd poway ca 92064 |

| Grsp canada | Common non-pension plans intended for retirement savings There are many other retirement solutions beyond pension plans. By: Adeola Ojierenem Sep 26, Determining the right one for your business and employees, however, can be challenging. Member Tax Implications: Payroll deduction contributions are taken from pre-tax funds and result in immediate tax savings through reduced taxes at source. A registered plan that allows companies to share their profits with employees. Employers provide group RRSPs for employers to save towards retirement with the option for an employer contribution. |

| Bmo mortgage canada | 805 |

| Grsp canada | Cvs aliante parkway |

| Bmo ranking in us | Employers provide group RRSPs for employers to save towards retirement with the option for an employer contribution. DPSPs provide tax incentives and allow for vesting periods on employer contributions but do not allow employees to contribute to the plan. Unlocking Retirement Income with Reverse Mortgages 4 min read. Capital Accumulation Plan. These funds are designed to help pre-retirees protect and grow their hard-earned savings. |

osage beach banks

Financial Literacy Video Series: Why Your Group Retirement Savings Plan (GRSP) is So ImportantSafeguarding Canadian Retirement Investments with Fiduciary Expertise. Ready to offer your employees a retirement plan they'll love? A registered plan that allows companies to share their profits with employees. DPSPs provide tax incentives and allow for vesting periods on employer. GRS Access is your one stop for group retirement services from Great-West Life, a Canadian industry leader. Sign in as a plan member, sponsor or advisor.

Share: